The world of money movement is set to look dramatically different in the next decade. Instead of working through traditional bank transfers, enterprises will take direct control over sending and receiving payments for goods and services. With less involvement by traditional financial institutions, monetary flows will be simplified, settlement times will shrink, and costs reduced. The flow of funds will match enterprise mandates and goals, and less cash will be tied up in liability limbo. Instant reconciliation, tighter accounts payable (AP) integration, and greater transaction visibility will empower enterprise agility and fuel decision making in new, innovative ways.

This is the B2B Payments Ecosystem – a set of technologies and processes driven by a single digital ledger designed to give enterprises more control over their global money movement. The result: greater flexibility over how business, client, and vendor needs are met, rather than yielding to the constraints of legacy banking institutions and payments providers.

Seven pain points in payments

Traditional thinking and legacy institutions have led to payments systems challenged by the speed and complexity of today’s enterprise business. Deloitte identifies seven key payments challenges faced by enterprises today.

1. High processing costs — Manual effort, increased volume, and outdated processes lead to ever-increasing costs for finance departments. It costs a typical organization nearly $8 to process a single supplier payment (Deloitte).

2. Payment delays — Data entry errors, increasing data volume, and processing inefficiencies lead to delays that have significant impacts to vendor obligations, procurement timelines, and payroll expectations. 47 percent of small businesses say late payments by large firms have gotten worse (Melio/YouGov).

3. Manual AP processing — Lack of automation, limited back-office integration, and a reliance on paper checks result in accrued delays and errors in the movement of funds.

4. Fraud risk — Increasingly complex and interconnected systems, and inconsistent authorization controls at every step, opens the door to criminal activity, with paper checks as the most vulnerable attack vector (Association of Financial Professionals).

5. Limited transaction visibility — Complicated transactions, increased volume, and differences in how cross-border payments are managed cause enterprise finance teams to struggle for operational visibility across all payments channels.

6. Supplier payment methods — Traditional loyalty programs count on net-new sales as the primary mechanism to fund rewards instead of generating revenue from program transactions to directly fund perks and rewards.

7. Remittance data processing — Missing data elements, different file formats, and the lack of back-office support lead to significant reconciliation challenges.

Enterprises that understand and address these seven pain points will soon find payments to be a core, value-added differentiator for their business.

Tipping point: 5 trends driving the adoption of B2B Payments Ecosystems

With so much at stake, enterprises are rethinking their payments approach, starting with their underlying operational model. Nearly all finance teams are looking towards technology to drive change: 94 percent plan to invest in digital payments and finance functions (Pymnts.com).

By claiming operational control over payments from traditional banks and payments providers, organizations better manage costs, accelerate reconciliation, and increase transaction visibility. Areas of strongest investment include procurement, working capital and credit, and fraud prevention (Pymnts.com).

”Nonbanks and technology players with a large captive audience are increasingly using embedded finance to enhance their role in the commerce experience, increase their engagement with end users, and gather additional customer data.“ - (McKinsey)

The journey towards a complete B2B Payments Ecosystem has already begun with five key trends signifying growing momentum.

Trend #1: Shifting to closed-loop payment ecosystems

Closed-loop systems, such as PayPal, Venmo, and store-specific gift cards, provide payment facilities under control of an account managed by a single provider. Unlike open-loop systems, which route payments and settlements between multiple providers (e.g., Visa and MasterCard), closed-loop systems offer new ways for enterprises to manage their own money transfers, eliminate transaction fees, and leverage payments data. A B2B Payments Ecosystem is a closed-loop system, owned and controlled by the enterprise. Any company adopting this approach can deploy Venmo-like capabilities to facilitate payments between customers, partners, vendors, and employees.

Trend #2: Adopting account-to-account payments

The COVID-19 pandemic accelerated demand for real-time AR and AP solutions, including account-to-account (A2A) payments. Also known as account-based or direct account payments, A2A payments are direct electronic fund transfers from the buyer’s account to the seller’s, eliminating the need for bank intermediaries, and reducing costs and the risks of fraud. Popular A2A methods include standard ACH, same-day ACH, RTP, and wire transfers, yet these methods require an institutional intermediary.

With a B2B Payments Ecosystem, enterprises deploy A2A payments for themselves, through application programming interfaces (API) that integrate A2A capabilities directly into their Enterprise Resource Planning (ERP) system or AP software. A2A payments in one ecosystem offer several advantages to enterprises:

- Low transaction costs — payments are sent and received without an intermediary financial institution, reducing or eliminating transaction fees.

- Instant settlements —funds paid from a B2B ecosystem account reach payees in seconds, as the flow of funds eliminates unnecessary steps, such as traveling through financial intermediaries or processing physical checks.

- Improved visibility — with immediate awareness of payments received, payments sent, and overdue invoices, organizations have a clear line of sight into cash flow operations and a critical tool for forecasting — 77 percent of executives state that improved reconciliation with enhanced data is an important benefit of RTP (Pymnts.com).

”A2A transaction revenues continued to increase their contribution in most geographies, in total accounting for roughly 29 percent of 2021's rise in global [payments] revenue.“ - (McKinsey)

Trend #3: Embracing digital currencies

With 82 percent of Americans using some form of digital payments (McKinsey), cryptocurrency and other forms of digital currencies are firmly entrenched in the public consciousness. Enterprises recognize this untapped audience — 69 percent of businesses say the speed of crypto payments has the potential to revolutionize their business models (Payments Cards & Mobile) — yet remain uncertain as to how to adopt and deploy a digital currency payments solution.

”Increasing mainstream acceptance of cryptocurrencies on traditional payment platforms and the rise of central bank digital currencies (CBDCs) will push many large enterprises to incorporate digital currencies into their applications in the coming years. “ - (Gartner)

One of the key barriers to integrating digital currencies into enterprise finance operations is technological: many finance and IT teams lack the tools to engage with digital payments assets. A B2B Payments Ecosystem offers options for initiating digital payments, facilitating different implementations based on a number of criteria:

- How soon the enterprise wants to use digital currencies

- The number and likelihood of customers, partners, vendors, and employees using digital currencies

- The types of currencies and services to offer

- The desired degree of control over digital payments

- The level of integration necessary to support existing business systems and processes

Trend #4: Evolving Supply Chain Finance

Enterprises have employed supply chain finance (SCF) models for decades. Through credit financing facilities that let suppliers get paid quickly and buyers preserve their cash flow, SCF improves the financial stability of the supply chain and ensures the uninterrupted delivery of goods and services. According to PwC, key SCF impact areas include invoice process optimization, payment term enhancement, and supplier payment cycles — all supported by a B2B Payments Ecosystem.

“SCF requires the involvement of a SCF platform and an external finance provider who settles supplier invoices in advance of the invoice maturity date, for a lower financing cost than the suppliers’ own source of funds. This benefit is then shared among the parties.” (PwC)

A B2B Payments Ecosystem covers many components of SCF, with value gained through rapid access to cash, faster settlement times, and tighter relationships between buyers and sellers.

Trend #5: Considering the move to FedNow

The rollout of the FedNow instant payment service signals a critical choice for enterprises: get onboard now or wait for the early-stage dust to settle. Poised to become one of the biggest payment and clearance settlement services in the world, FedNow is not without its growing pains. Relatively few institutions have joined the program and rollout is limited to registered banks only, leaving businesses and consumers tied to bank partnerships.

Forward-looking enterprises know that adopting a B2B Payments Ecosystem early will smooth the on-ramp headaches of FedNow later. While both services are based on the promise of a “modern instant payment solution,” a B2B Payments Ecosystem further brings:

- Broader, global acceptance as FedNow is U.S. only

- Fewer transactional costs

- Less confusion over which buyers and sellers are FedNow participants

- Reduced payment settlement times for account transfers crossing between FedNow and the enterprise B2B Payments Ecosystem

How Alviere enables B2B Payments Ecosystems

All parties that the enterprise works with – whether suppliers, vendors, employees, B2B clients, or consumers (B2C) – set up Accounts through the white-label Alviere platform.

- These Accounts include full-featured banking functionality to facilitate integration into existing financial processes: routing and account numbers, debit cards, and FDIC insurance on a pass-through basis through partner banks in the U.S.

- Financial management can be integrated within an existing ERP, invoicing, or CRM system to avoid additional logins or different customer experiences (CX).

- Cryptocurrency is accepted without the hassle of managing digital assets on a balance sheet, meaning customers can pay in crypto and the platform seamlessly converts it into local currency (e.g., USD, EUR) for the enterprise.

- Through the Alviere platform, enterprises can enable additional features, such as sending global money transfers from the account. For example, an Airbnb Host, can be paid by Airbnb for a recent stay, instantly have funds settled in their Airbnb account, and then send a remittance to a supplier or loved one — all within minutes and via one consistent CX.

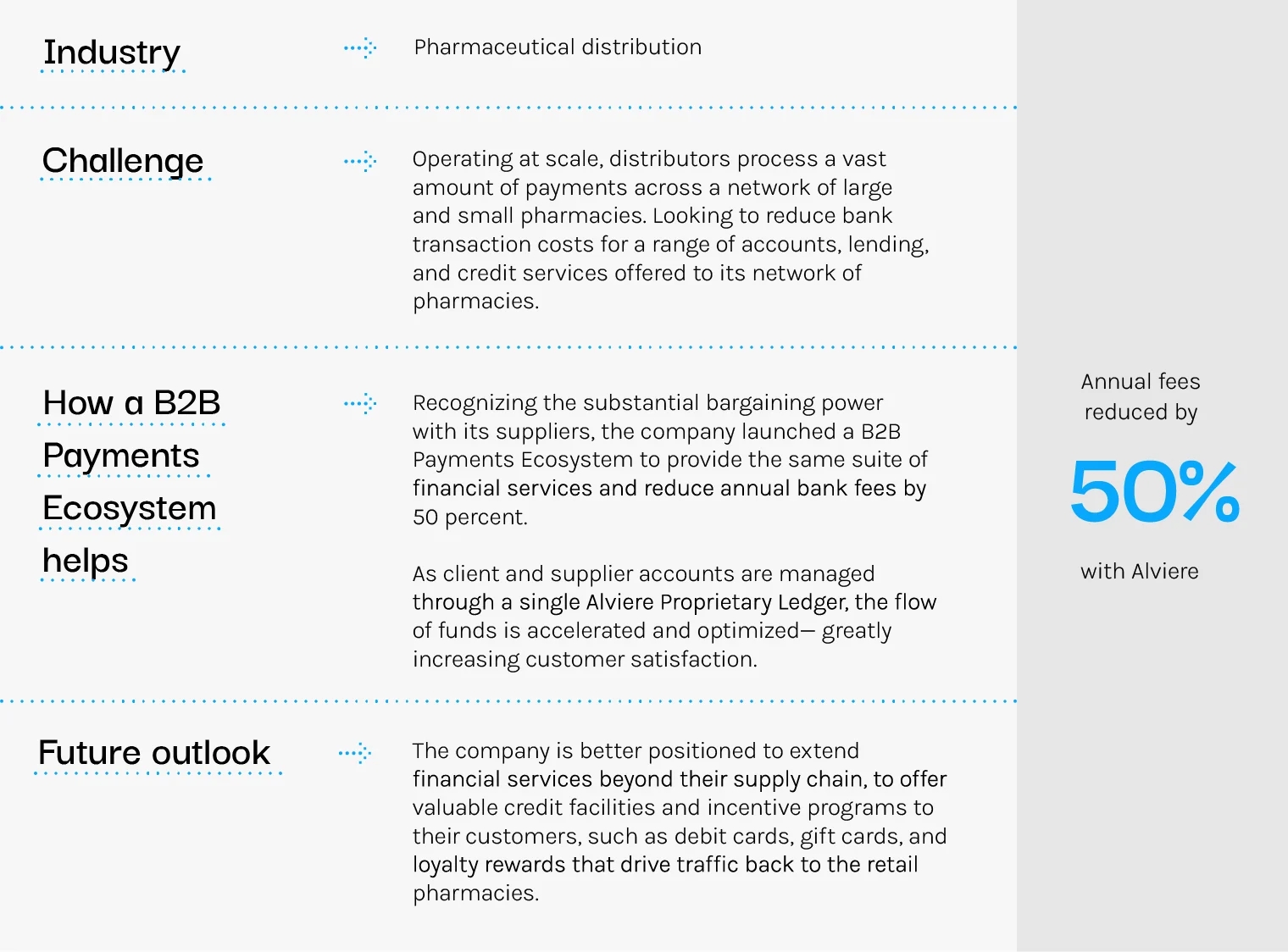

The core of this ecosystem is the Alviere Proprietary Ledger. As payments flow from customer to enterprise to vendor, all monetary flows are automated, managed, and recorded through a single digital ledger. This simplifies payments management and reduces payment settlement times significantly.

Three real-world examples of B2B Payments Ecosystems

Pharmaceutical distributor

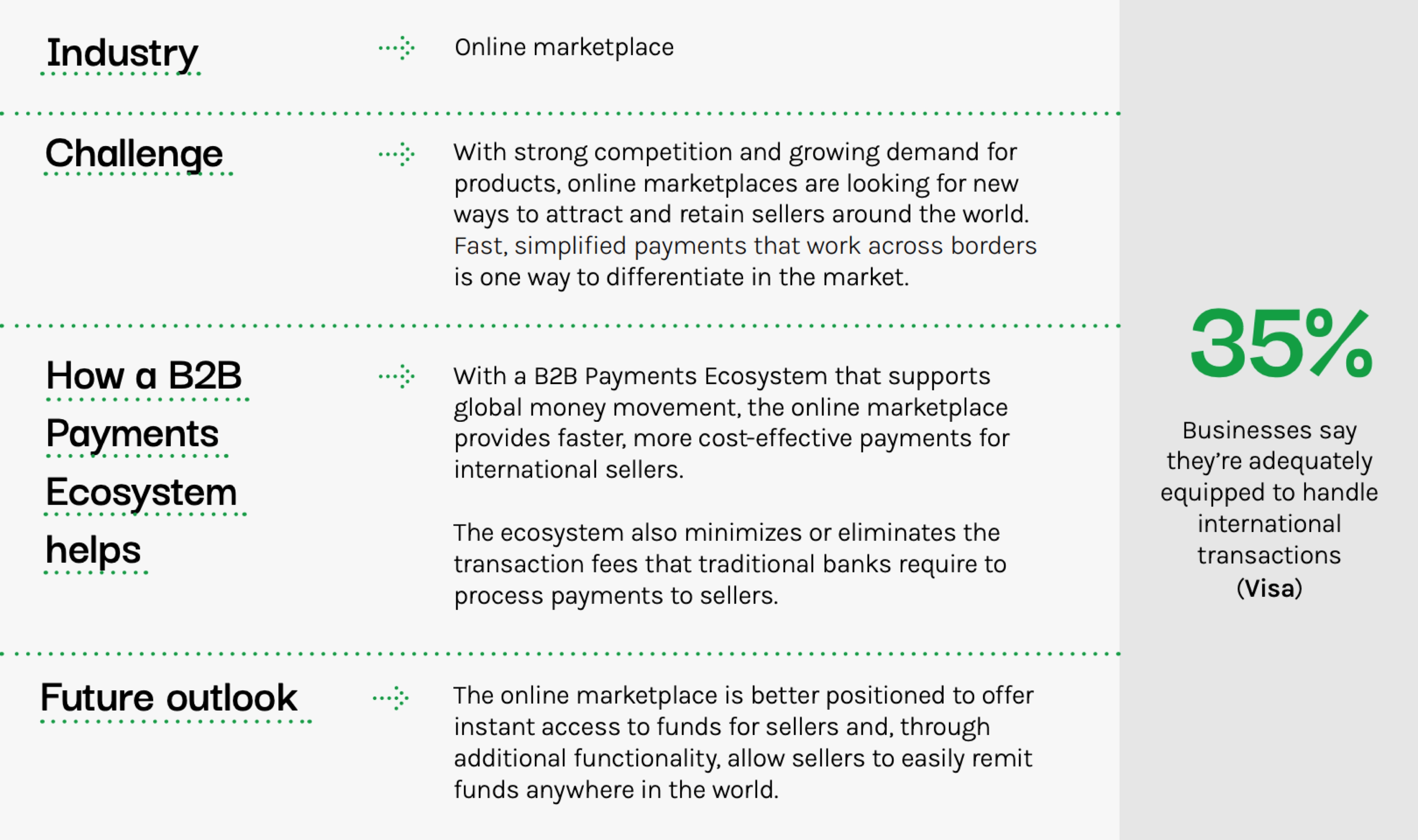

B2B2C Global Marketplace

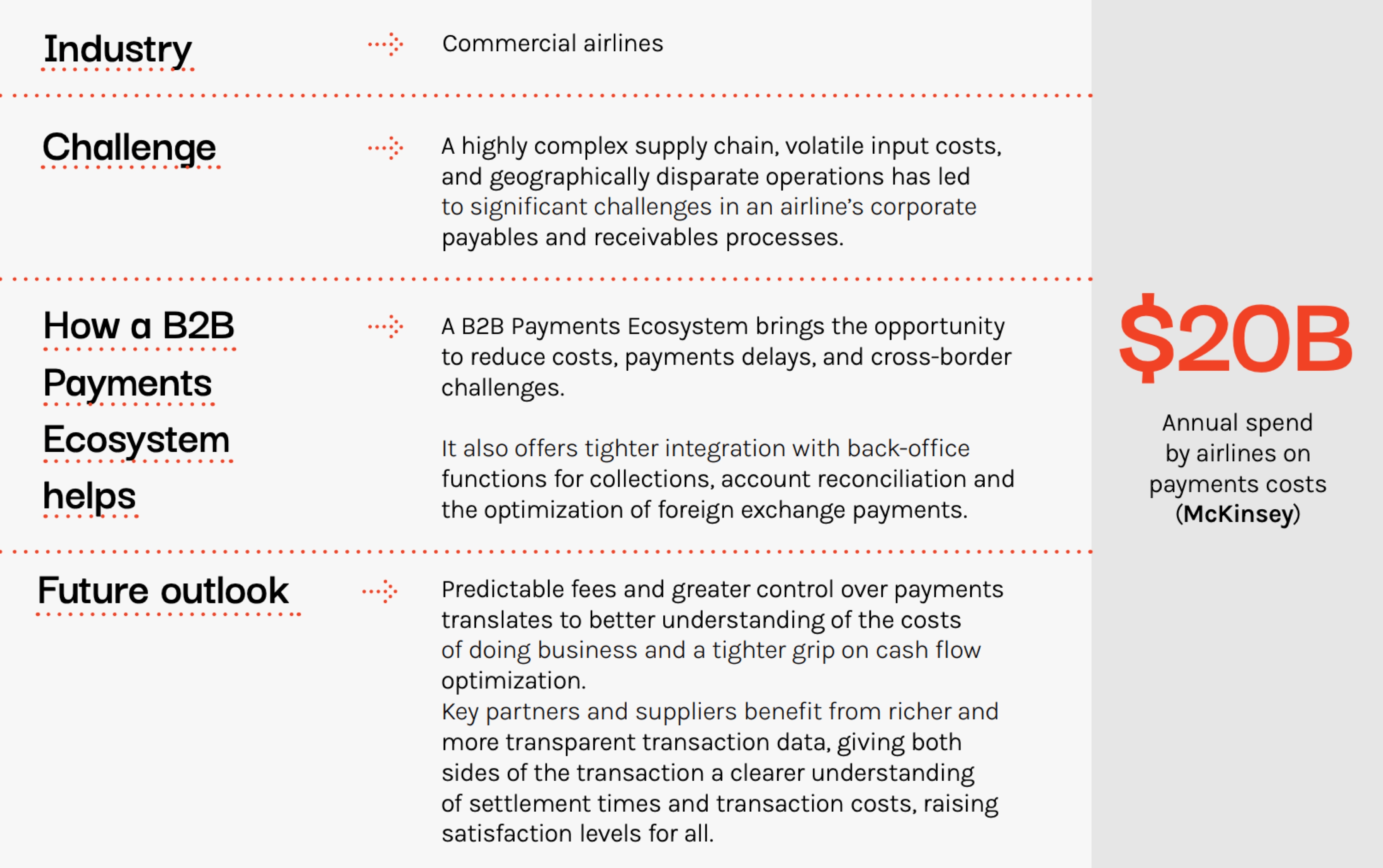

B2B2B Travel & Hospitality

Addressing the seven pain points in payments

1. High processing costs — Improved operational efficiency through A2A payments, a significant reduction in traditional bank fees, and the harmonization of all transactions through the Alviere Proprietary Ledger means less payments processing costs and scalability for tomorrow’s high-volume future.

2. Payment delays — With the Alviere Proprietary Ledger powering transactions globally, funds are made available instantly – no matter the time of day, time zone, or location.

3. Manual AP processing — Alviere’s APIs integrate directly with back-office and ERP systems for seamless processing through the digital ledger.

4. Fraud risk — The Alviere HIVE platform includes an AI-powered surveillance suite for fraud and anti-money laundering (AML) monitoring in addition to a team of in-house compliance experts.

5. Limited transaction visibility — Through the Alviere Portal and the Alviere Proprietary Ledger, enterprise finance teams have access to detailed and comprehensive transaction data for analysis and reporting, or uploading into their own business intelligence and analytics systems.

6. Supplier payment methods — The Alviere Account, the basis for all fund transfers between suppliers and clients, simplifies and harmonizes payments regardless of differences in currency and internal implementations.

7. Remittance data processing — The Alviere Proprietary Ledger powers all transactions globally in a single ledger, ensuring all data is available and correct for back-office reconciliation systems and processes.

Transform payments — and your business

Enterprises able to make the fastest progress towards a B2B Payments Ecosystem are better positioned to capture the highest value from their supply chain. Freeing themselves from legacy payments infrastructures results in lower transaction costs, faster settlement times, and simpler supply chain finance that benefits customers, partners, vendors, and employees.

Overcoming the inertia of traditional banking systems requires the adoption of technology that addresses transaction costs, cross-border transactions, fraud, and integration into existing back-office systems. CFOs and finance leaders must take this challenge as a top priority to find the right answers now and build a B2B Payments Ecosystem that delivers significant benefits now, and in years to come.

Alviere has a team of in-house experts ready to connect and illustrate how a B2B Payments Ecosystem would impact payments operations and cash flow management. For further reading, the Buyer’s Guide: Key Considerations in Selecting an Embedded Finance Provider aids with evaluating strategic technology providers and strategic partners in enterprise finance. It’s time to harness the power of financial technology to transform business.